What is GST? What is GST?

Goods and Services Tax (GST) is the accumulation of prevailing Central and State Taxes in India into a single tax. It is biggest and most significant reformation of Indian Indirect Tax Structure till date. GST will mitigate the cascading or double taxation of present taxation, facilitating a common national market. Goods and Services Tax would be a comprehensive indirect tax on manufacture, sale and consumption of goods and services throughout India, replacing various taxes levied by the Central and State Governments.

Features of GST

- GST or Goods and Services Tax is a comprehensive tax applicable on goods & services, which will flow against the present tax structure of multi-level taxation.

- GST will subsume Central Indirect Taxes like excise duty, countervailing duty and service tax, and State Levies like value added tax, octroi and entry tax, luxury tax etc.

- It will be a Destination Based & Multipoint Tax and not the Origin based tax

- It will be a Dual GST having two components –

- Central GST– CGST levied by the Centre, and

- State GST– SGST levied by the states

- Intra-State supplies of goods & services are liable to CGST & SGST on identical Tax Base

- Import of Goods or Services would be treated as inter-State supplies and would be subject to IGST in addition to the applicable customs duties

- Inter-State supplies of goods & services are liable to Integrated Goods & Services Tax (IGST) by the Centre.

- GST would subsume the following taxes currently levied and collected by the Centre:

- Central Excise duty

- Countervailing duty

- Service Tax

- Octroi and Entry Tax

- Duties of Excise (Medicinal and Toilet Preparations)

- Additional Duties of Excise (Goods of Special Importance)

- Additional Duties of Excise (Textiles and Textile Products)

- Special Additional Duty of Customs (SAD)

- Cesses and surcharges insofar as far as they relate to supply of goods or services

- State taxes that would be subsumed within the GST are:

- State VAT

- Central Sales Tax

- Purchase Tax

- Luxury Tax

- Entry Tax (All forms)

- Entertainment Tax (not levied by the local bodies)

- Taxes on advertisements

- Taxes on lotteries, betting and gambling

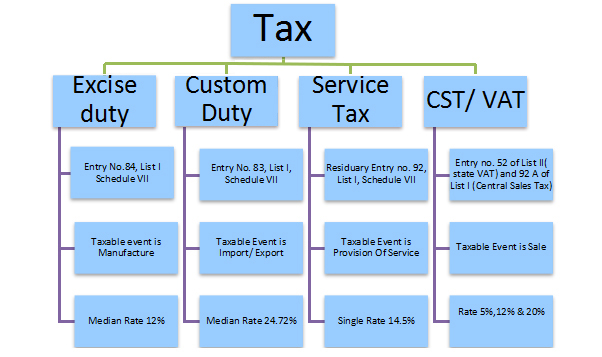

Present Tax StructurePresent Tax Structure

What’s Out of GST?What’s Out of GST?

- Alcohol for human consumption and Electricity are kept out of GST by way of definition of GST on constitution.

- Five petroleum products viz. Petroleum Crude, High Speed Diesel, Motor Spirit (Petrol), Natural Gas & Aviation Turbine Fuel have temporarily been kept out and GST Council shall decide the date from which they shall be included in GST.

- 1% origin based Additional Tax to be levied on inter-state supply of goods will be non-creditable in GST chain. The revenue from this tax is to be collected by Centre and assigned to the originating state. This tax is proposed to be levied for initial two years or such period as recommended by the GST Council.

- Stamp duties, typically imposed on legal agreements by the state, will continue to be levied by the States.

GST differsGST differs

How GST differs from present Taxation Machine?

Common Indian Market:

GST will provide a unified, common Indian market, taking away two different taxes i.e. Central and State Tax. It shall provide a comprehensive Tax base for all goods & services i.e. no other taxes are to be implied on goods & services, besides GST.

Eliminating the Cascading Effect:

GST is supposed to abolish the cascading effect by removing multi- level tax implications at various stages. At present, a product on which excise duty is paid can also be liable for VAT.

For eg., a product A is manufactured in a factory. As soon as it releases from factory, excise duty has to be paid to central government. When that product A is sold in same state then VAT has to be paid to state government. Also no credit on excise duty paid can be taken against output VAT. This is termed as cascading effect since double tax is levied on same product.

With GST, no goods or services are to be taxed again and again.

What GST will giftWhat GST will gift

Escaping Tax Evasion:

Biggest Benefit is that it will reduce the incentive of tax evasion. GST will create a trail of several transactions as, at every level traders will have to register their invoices to claim input tax credits. If you don’t pay tax on what you sell, you don’t get credit for taxes on your inputs. Also, you will buy only from those who have already paid taxes on what they are supplying. Result: a lot of currently underground transactions will come over ground. Further, whole process will be online; the compilation of state and central indirect taxes will provide a comprehensive and transparent picture of a taxpayer.

Allied Market:

The roll-out of GST will convert India into one common market, preventing tax-on-tax and making goods and services cheaper. The GST will do away with the large number of taxes imposed by the central government (eg. central VAT or excise duty, services tax, central sales tax on inter-state sales, etc.) and states (VAT on sales, entertainment tax, luxury tax and octroi and entry taxes levied by municipalities). This will lead to the creation of one common market at national level, which would facilitate seamless movement of goods across states and reduce the transaction cost of businesses, while ensuring that there is no negative revenue impact on the states.

Tax Rates Lowered:

Lower Tax Rates will follow from GST covering all goods and services, with tax only on value addition and set-offs against taxes on inputs/previous purchases. At present, we have more tax on fewer items; however with GST, there will be less tax on more items. Ideally, no good or service should be tax-exempt, as this will break the input tax chain. The ordinary businessman and the common tax man will benefit from introduction of GST by way of lower tax rates.

Broader Tax Base:

GST will give credits for all taxes paid earlier in the goods/services chain incentivizing tax-paying firms to source inputs from other registered dealers. This will bring in additional revenues to the government as the unorganized sector, which is not part of the value chain, would be drawn into the tax net, thus projecting a widened Tax Base. Besides, states will be allowed to tax services (as opposed to only the central government) under the GST.

Implementation of GST in IndiaImplementation of GST in India

- Setting up IT Network by GSTN

- Final CGST, SGST, IGST Legislation’s

- Draft GST Legislation's of CGST/IGST and Model SGST Legislation’s

- To set up GST Council within 60 days of Assent of the President

- 26th September, 2016: GST Draft Rules and Formats issued by CBEC

- 8th September, 2016: Bill followed by the Presidential assent.

- Bill receives assent & becomes the Act

- 1st September, 2016: Being a constitution amendment that involves the states, requirement of ratification by more than 50% of State Legislatures completed.

- 8th August, 2016: Since the present bill bears certain amendments, the bill was tabled at Lok Sabha and passed again, as approval by both the houses of parliament was required.

- 3rd August, 2016: GST constitutional Bill (One Hundred and Twenty-Second Amendment) Bill, 2014, as passed by the Rajya Sabha.