GST roll-out delay won’t impact India’s bid for better Doing Business ranking

Live mint

By Asit Ranjan Mishra

Tue, Jan 10 2017. 10 34 AM IST

Because the GST reforms—whether implemented in April or September—will be considered only in the next year’s Doing Business report

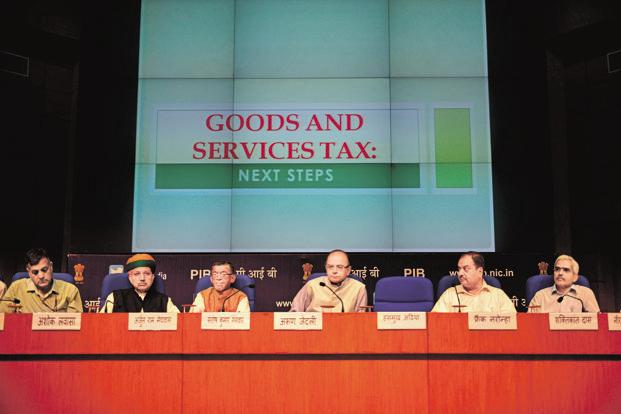

Union finance minister Arun Jaitley addresses the media on Goods and Services Tax in New Delhi. A file photo: Mint

New Delhi: An impending delay in implementing the Goods and Services Tax (GST) reform from its earlier deadline of 1 April is unlikely to impact India’s hope for a better World Bank Doing Business ranking.

This is because while for most indicators, the deadline for implementing reforms is 31 May, for tax reforms, the deadline is 31 December, or seven months prior to the deadline for other reforms.

This would mean that the GST reforms, whether implemented in April or September, will be considered only in the Doing Business report, which will be released next year.

“It does not matter if the GST is delayed from April to September as we have time till end of December to implement it to get the benefit next year in the World Bank ranking,” a DIPP official said on condition of anonymity.

Doing Business records the taxes and mandatory contributions that a medium-size company must pay in a given year as well as the administrative burden of paying taxes and contributions and complying with post-filing procedures.

The World Bank included the “post-filing index” criteria for the first time last year under the “paying taxes” parameter. It measures what happens after a firm pays taxes, such as tax refunds, tax audits and administrative tax appeals.

India scored abysmally low on “post-filing index” criteria, scoring 4.27 out of a maximum score of 100. This has kept India’s “paying taxes” ranking unchanged at 172 among 190 countries, limiting its overall improvement in ranking to just one rank to 130 in this year’s ranking.

After the GST is implemented, the “post-filing index” for India is expected to significantly improve as instead of paying 14 indirect taxes, businesses will pay only a single tax with minimal scrutiny and quicker refunds.