Impact of GST on the Agriculture Sector Impact of GST on the Agriculture Sector

What is GST?

Goods and service tax or GST is a single tax on the supply of goods and services, right from the manufacturer to the consumer. The final consumer will have to pay GST to the last supplier in this complex chain. The introduction of GST replaced both Central level taxes like excise and service tax, customs duty and state taxes like VAT, CST, Octroi & Entry Tax, Entertainment Tax, etc.

The single largest sector contributing to the Indian Economy is the Agriculture. It alone accounts for up to 16% of the Indian GDP. Hence, the Effect of GST on Agriculture Growth was one of the major concerns after the implementation of GST taxes in the country. Furthermore, the Impact of GST on Agriculture Sector was expected to be more of an indirect impact. However, the real question of this polemical topic is whether the Role of GST in Agriculture has proven to be beneficial for this market sector or has acted as a bane.

Laws Prior to the Implementation of GST Rate on Agriculture

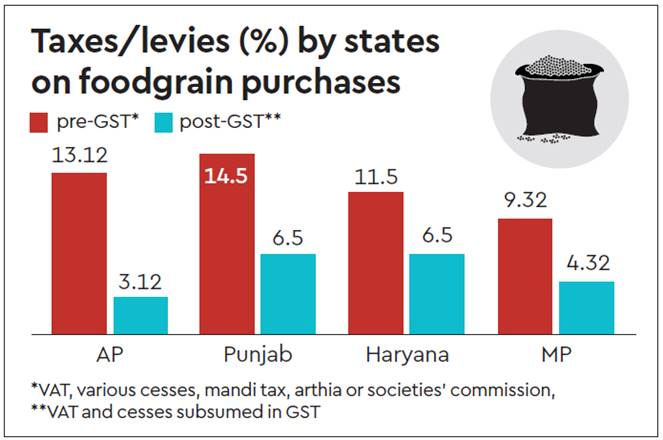

Before the implementation of GST on Agriculture, certain food items like rice, sugar, salt, wheat, and flour were free from paying taxes under CENVAT. Also, agricultural products went through numerous licensing processes earlier. Thus, a number of indirect taxes (VAT, excise duty, service tax) were applied under the previous tax laws. Under the state VAT, cereals and grains were taxed at the rate of 4%.

National Agricultural Market (NAM)

National Agricultural Market (NAM) is a national scheme introduced by the central government. It provides all the farmers and traders in the markets with a singular and uniform e-commerce platform for a transparent and impartial trade of agri-commodities. Prior to the GST effect on the Agriculture Industry, the implementation of NAM scheme was challenging due to non-uniform and variable state VAT and APMC (Agricultural produce market committee) laws.

Image Source

However, there have also been huge Advantages of GST on Agriculture - As after GST has been levied, a successful path for the establishment and implementation of NAM has also been created. Majority of the indirect duties levied on agricultural products have been absorbed under the GST Rate on Agriculture. This allows every farmer, trader, and cultivator to receive the input credit for the tax paid on every value addition, thus, creating a transparent, hassle-free, and convenient supply chain. Moreover, this has led to the free and quick movement of agri-commodities across different state borders within India.

GST Impact on Agriculture Sector

Image Source

Fertilizers

Earlier, fertilizers were subjected to a 0-8% VAT which, after GST, will attract 12% tax. This has increased the prices of fertilizers by 5-7%.

Pesticides

Pesticides have been put in the 18% tax slab, increasing from the pre-GST 12% duty and VAT of 4-5% in some states.

Tractors

Tractors have been placed in 12% excise slab, while several of its components and accessories have been put in the 28% slab.

Pumps

GST rate on pump sets has been decreased to 18% from 28%, thus, reducing manufacturing costs and driving sales indirectly.

Agri-Commodities

Highly used agri-commodities such as rice, wheat, milk, fresh fruits, and vegetables are placed in the zero tax slab. This helps in evading tax, cess, and Arhatiya commission imposed by some States.

Fresh Produce

Fresh fruits and vegetables are not subject to any taxes. However, higher rates of 12% and 18% have been introduced for dry fruits and preparations from fruits and vegetables, such as fruit jellies, pastes, jams or juices which were taxed at a rate of 5% earlier.

Frozen Produce

Frozen or chilled fruits and vegetables whether cooked or uncooked, preserved fruits, vegetables and nuts, and areca nuts are taxed at 5%.

Processed Produce

processed foods like fruit and vegetable juices under GST will be taxed at 12%, up from 5%. Some items like fruit jams, jellies, marmalades, etc. will be taxed even higher at 18%.

Benefits of GST on Agriculture Sector

After the implementation of GST, all farmers, traders, and cultivators are liable to pay taxes. So, the earlier category of people who were exempt from taxes no longer exists under GST.

Also, it saves the agricultural workforce from paying the service tax under the GST implementation laws and guidelines. Along with this, most non-processed agricultural and cultivated products have also been exempted from taxation.

Is GST Beneficial?

Initially, in the immediate aftermath of GST implementation, various states like Maharashtra, Punjab, Gujarat, Haryana, etc., will face quite a bit of revenue loss. The revenue, which was earlier generated by charging CST/OCTROI/Purchase Tax, will be compensated to the respective states. But, implementation of GST taxes is going to benefit a lot of farmers, traders, cultivators, and distributors, in the long run, owing to its creation of a single unified national agriculture market. It is designed for farmers to sell their produce for the best available price.