Impact of GST on Real Estate Impact of GST on Real Estate

The Goods and Service Tax was introduced in India on 1st July 2017. As we celebrate the first anniversary of this landmark reform, it is interesting to see the definitive impact on various sectors as most of the teething troubles have been resolved. To recap, GST was implemented due to 2 key reasons:

Simplification of Taxes: India's post-Independence tax regime was a complicated web of taxes such as Sales Tax, Value Added Tax (VAT), and several more charges applied by the state and central government.

Formalization of the Economy: As per this Economic Survey conducted by India's Chief Economic Advisor and his team, 21% of India's total turnover is contributed by the informal sector. GST will reduce this number as more companies come under the tax net.

The real estate sector has suffered from both these issues in the past and the new tax regime is expected to lead to an overhaul in real estate operations.

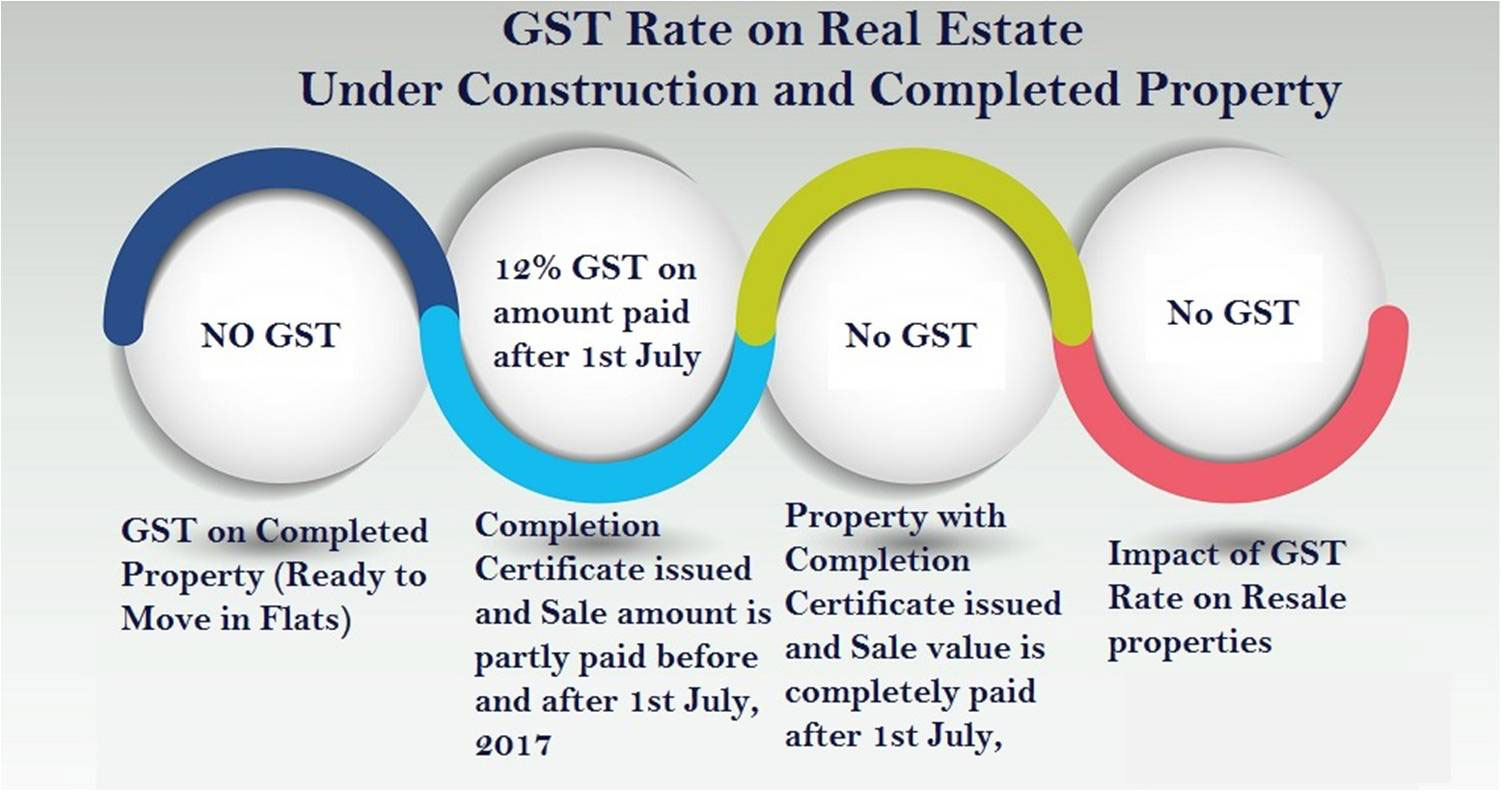

The impact of GST on the Indian Real Estate sector is far-reaching with implications for all, builders, developers, and customers. Some of the changes posts GST are listed below.

Image Source

1) Under-Construction Properties

Previously, a buyer of an under-construction property had to pay a slew of charges like Service Tax, VAT, Stamp Duty, and Registration Charges. Of these, VAT and Registration Charges were state levies with different rates in each state calculated on the value of the property and Service Tax levied by the central government which is calculated on the cost of construction. As seen above, the calculations for these taxes were non-standard and complicated for the average home-buyer.

With a standard GST rate of 12% charged on the value of the property, the calculations have become simpler for developers to charge and customers to understand. Also, the developer can claim a credit of the GST paid for the purchase of raw materials and labour. The tax can be passed on to the customer in the final billed value.

It is also important to note that consumers continue to pay stamp duty and registration charges as they are state levies; these are to be subsumed at a later date.

2) Completed Constructions

No GST can be charged from a buyer in case the construction of a property is completed and ready to move in. Since the prices of real-estate properties are decided on demand-supply dynamics rather than the cost of construction, this provision is not expected to be disadvantageous to the builders.

Image Source

3) No Tax Credit for Stamp Duty Paid

Perhaps the biggest peeve that builders have from the new tax regime is the stamp duty of 6% to the state government for which they cannot claim credit. The dual tax burden of GST and stamp duty increases overall costs and jacks up prices for developers or purchasers.

Need help managing payroll? See here!

4) Positive Effects from Ancillary Industries

The real estate industry is benefiting from the different rates charged for the raw materials required for construction of buildings.

a) Cement is taxed at 28%, higher than the previous rate of 23-24%. However, the elimination of a host of other taxes has been subsumed under the GST regime.

b) Iron rods are charged at 18%, marginally below the previous average rate of 19.5%.

c) Bricks are charged at 28% with the exception of ceramic building bricks which are charged at 5%. Previously, all bricks were charged at an average rate of 25-26%.

While the rates of taxes are in line or marginally higher than the rates charged previously, the logistical cost of transporting cement, iron rods, and bricks have reduced as several over-lapping levies have been subsumed.

5) Lower Taxes for Low-Cost Housing Projects

In order to push the Prime Minister's agenda of 'Housing for All', the government recently decided to lower the applicable GST rate for home purchases under the Credit-Linked Subsidy Scheme (CLSS) of the Pradhan Mantri Awas Yojna (PMAY) to eight percent. This concession has also been extended to apartments up to 60-square meter carpet area.

6) Improved Perception

The Implementation of GST in addition to the RERA (Real Estate Regulatory Authority) Act helped in boosting the image of the sector as developers and builders operate under more accountability and stringent solvency requirement.

The impact of GST on the Real Estate sector has been minimal in terms of tax rates. In the long-term, the industry and customers will benefit from the increased transparency and accountability which has so far evaded the functioning of the sector.

Video: E-Way bill Automation in Tally

The real estate sector is one of the most unorganized sectors contributing a bulk to the Indian informal economy. You can contact us for any queries regarding the impact of GST on the Real Estate sector.