Differences hobble GST agenda, but not timeline

Live mint

By Remya Nair

Wed, Oct 19 2016. 06 21 PM IST

The states’ compensation and GST rates to be worked out at the tax council’s next meeting on 3-4 November

New Delhi: Differences in the goods and services tax (GST) council have delayed a compromise on the GST rates, the funding pattern for compensation as well as distribution of oversight powers between the centre and the states.

However, expectations are that these differences are not insurmountable and are likely to be resolved at the next meeting of the GST council on 3-4 November.

A go-ahead from the council is key to the government being able to finalize the draft supporting legislation before the last week of November. Passage of the central GST and integrated GST bills in the winter session of Parliament will be imperative to roll out GST by 1 April.

GST, a landmark tax reform, will remove tax barriers across states and integrate the country into a common market.

“We have converged towards a consensus on source of funding for state compensation,” said finance minister Arun Jaitley, adding that the question is if the funding will come through levy of cesses or through additional taxes. “In the next meeting, we will discuss the issue of compensation and tax rates,” he said. “Once the GST rates are decided, the GST council will meet again on November 9-10 to finalize the draft legislations,” he added.

Though a discussion on the rates and the structure was scheduled for Thursday, states sought more time to study the calculations made by the centre.

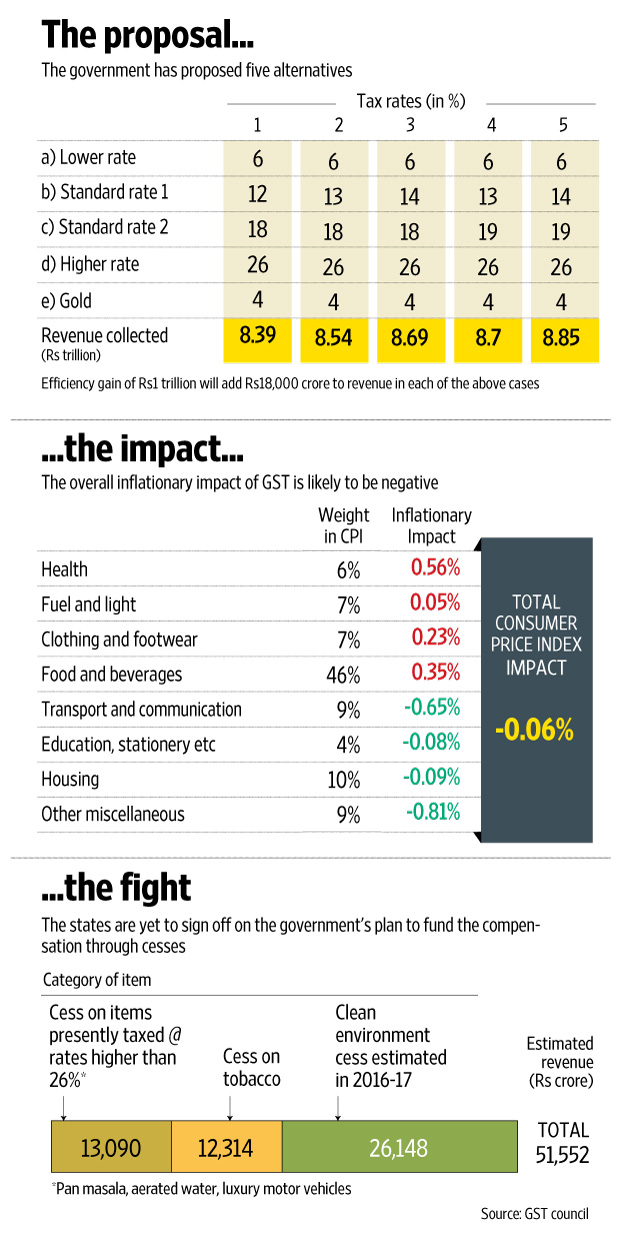

The centre proposed a multi-tiered rate structure—4% for gold, 6% on essential commodities where no excise duty is levied but a low rate of value-added tax is levied, two standard rates of 12% and 18% where a majority of the items will be taxed, a high rate of 26% for packaged consumer goods and 26% plus cess for luxury items and sin goods such as luxury cars, tobacco, pan masala and carbonated drinks.

Some states opposed the proposal of keeping the highest slab at 26% and suggested a higher rate. The levy of cess, too, was opposed by a few states that argued that GST revenue cannot be used to compensate them. However, the centre did not yield.

The centre estimated the total compensation to states on account of losses arising from a transition to GST at Rs50,000 crore in the first year. Of that, Rs26,000 crore will come from the corpus generated by the levy of the clean environment cess; the balance will be collected from the cesses to be levied on so-called demerit and sin-goods.

“It was a good meeting in the final analysis. Most state finance ministers were speaking to their constituencies and eventually came around,” said a person who attended the meeting.

However, the issue of sharing of administrative powers between the centre and the states over traders as well as service tax assessees could not be resolved. This has been a longstanding dispute, with neither side willing to cede control over traders. It was initially agreed that traders below a revenue threshold of Rs1.5 crore would be administered by the states. However, all services tax assessees were to be under the centre’s control, which was opposed by some states, prompting a rethink.

“The issue of dual control for both goods and services is back on the drawing board. A new mechanism will be worked out,” said a person familiar with the development.

M.S. Mani, senior director, indirect tax, Deloitte Haskins and Sells LLP, said the delay in finalizing the rates indicates the vexing issues involved in fixing rates, but pointed out that any further delays could run the risk of delaying the GST rollout. “The discussions on levying a cess on certain products would in some ways defeat the purpose of rolling out a single tax replacing all taxes and cesses and it needs to be ensured that such cesses are levied on very few products on an exception basis,” he said.