GST timeline derailed, but direction unchanged

Live mint

By Remya Nair

Wed, Jan 04 2017. 03 29 PM IST

Some states also raised a new issue of a rate split under the GST in the GST Council meet, which has been convened next on 16 January.

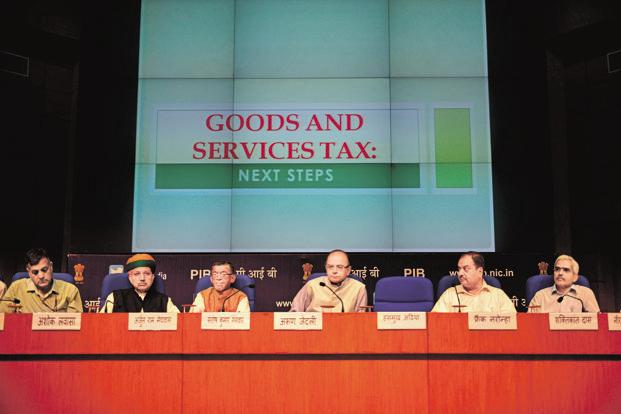

A file photo of the GST Council meeting in New Delhi last year. Photo: Pradeep Gaur/Mint

The eighth meeting of the goods and services tax (GST) council remained inconclusive on Wednesday, effectively ruling out implementation of GST from 1 April.

However, both the centre and the states made headway on the integrated GST bill at the two-day meeting, though the contentious issue of sharing of administrative powers was not taken up.

States—including Kerala, Delhi, West Bengal, Karnataka, Meghalaya and Tamil Nadu— also raised a new issue of a rate split under GST. Instead of equally dividing the GST tax rate as envisaged initially by the centre while arriving at the revenue estimates of GST, states are now demanding that the split in the tax rate should be in the ratio of 60:40.

This means that if the highest tax rate under GST is 28%, then states are demanding that state GST rate should be 60% of 28%, and the central GST rate be 40% of 28%, instead of 14%+14%.

The GST council will take a final call on this issue.

The delay in finalization of the supporting legislations for GST rule out its implementation from April 2017, with the new rollout date expected to be either 1 June or 1 July, though many states pointed out that given the huge amount of work still remaining, 1 September may be more realistic. The next meeting of the GST council will take place on 16 January, wherein the issue of sharing of administrative powers will be discussed.

“An overwhelming majority of the states had a positive attitude and we have started a discussion that was inconclusive. The GST council has approved 10 of the 11 chapters of the Integrated GST law. Some issues such as dual control and cross empowerment and the issue of powers to states to levy taxes in territorial waters remain open,” said finance minister Arun Jaitley in a press conference.

Jaitley, however, remained non-committal on meeting the 1 April deadline. “We are moving against time...That’s why we are meeting again (on 16 January),” he said.

However, the government is parallelly moving to ensure that the legal drafts of the supporting legislations are ready to be tabled in the upcoming budget session of Parliament. It has sent the draft of the legislations for legal vetting while leaving gaps in them for issues that remain unresolved.

The states and the centre also agreed that the language of the draft compensation bill will be tweaked to provide compensation to states from the proceeds of the cess as well as other sources as decided by the GST council.

Kerala finance minister Thomas Isaac said that the centre seems to be in a mood to reconsider its stance on some issues. “The centre is appreciating the position of the states—be it our concerns on compensation or reconsidering it’s stand on the issue of territorial waters,” he said, expressing hope that the next meeting of the council will find a solution to the issue of sharing administrative powers between the centre and the states.

While states such as Tamil Nadu, West Bengal and Kerala are sticking to their demand of having administrative control over all taxpayers who have an annual revenue threshold of less than Rs1.5 crore and equal division between the centre and the states for those above this level, the Modi government is unwilling to yield to this demand as it will leave it only a small taxpayer base of around 700,000 to administer. The other option being discussed is to only divide the small pool of taxpayers that are likely to be audited under GST.

Jaitley reiterated that the government will strive for a consensus in the council .“I have been consciously avoiding voting. GST council is a federal institution. Its initial functioning will be cited as a precedence in the years to come,” he said.

Pratik Jain, partner and leader-indirect tax at PwC India, said the industry needs clarity on the implementation date of GST to prepare for the transition and make business plans for next year.