GST: States adamant on sole control over small businesses

Business Standard

By Press Trust of India

November 14, 2016. 15:48 IST

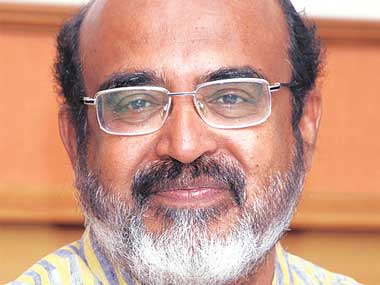

Thomas Issac on Monday said that a vertical division of assessees for collection of taxes and for the purpose of audit would create problems for small taxpayers.

With states and Centre set to meet this week to chalk out jurisdiction over assessees under goods and services tax (GST), a majority of states, including Kerala, West Bengal and Delhi, are sticking to their stand of sole control over entities with turnover below Rs 1.5 crore.

With states and Centre set to meet this week to chalk out jurisdiction over assessees under goods and services tax (GST), a majority of states, including Kerala, West Bengal and Delhi, are sticking to their stand of sole control over entities with turnover below Rs 1.5 crore.

Kerala Finance Minister Thomas Issac on Monday said that a vertical division of assessees for collection of taxes and for the purpose of audit would create problems for small taxpayers.

"Kerala, Bengal, Tamil Nadu, Bihar, Delhi, Odisha... majority of states want a combination of vertical and horizontal (dual control structure). Below Rs 1.5 (crore turnover), states should tax, above Rs 1.5 crore, it can be vertical division," Issac said.

After nailing a four-tier rate structure of 5, 12, 18 and 28%, the GST Council at its meeting on November 4 failed to reach a consensus on which category of assessees would be governed by the Centre and which by states.

The finance ministers of states will now informally meet Union Finance Minister Arun Jaitley on November 20 to evolve a political consensus on the sticky issue.

The next meeting of the GST Council, headed by Jaitley, is scheduled for November 24-25.

Differences on the issue of cross empowerment to avoid dual control arose with states demanding control over 11 lakh service tax assessees, and Centre proposing to do away states having exclusive control over all dealers up to an annual revenue threshold of Rs 1.5 crore — an issue which was settled in the first meeting of the GST Council.

The Council has arrived at an option of two proposals — horizontal division and vertical division.

'Horizontal division' would mean taxpayers would be divided both for administrative and audit purposes based on a cut off turnover. Those with a turnover over Rs 1.5 crore would be administered both by the Centre and states, while those with below Rs 1.5 crore would be administered solely by the states.

'Vertical division' based on ratios assigns taxpayers to a tax administration, Centre or state, for a period of three years for all purposes including audit. Taxpayers could be divided in a ratio which would balance the interest of the Centre and the state, both with respect to revenue and spread of numbers.

According to sources, the Centre feels that horizontal division would be lopsided as 93% of Service Tax assessees and 85% of VAT (value added tax) taxpayers have a turnover below Rs 1.5 crore.