India must take GST lessons from other nations: CFO survey

Business Standard

By Subhayan Chakraborty

February 21, 2017. 00:52 IST

Countries like Malaysia and Canada have struggled with preparation time, rate issues, tax laws

Before the Goods and Services Tax (GST) reform is rolled out, India should take cautious lessons from other nations which have also introduced similar legislation, industry leaders have warned.

A report released on Monday by the Confederation of Indian Industry and tax consultancy major Deloitte, which incorporates the views of Chief Financial Officers (CFO) of major companies, said the experience of other nations like Malaysia, Canada resonated with challenges currently being faced by India.

LESSONS TO BE LEARNT

|

Malaysia:

Almost 1.5 years given for preparedness Sector specific guidance paper on tax treatment

Anti-profiteering regulations

|

|

Canada:

Multiple provinces, variety of tax rates Challenges under GST/HST due to interpretation issues

|

|

European Union:

Complicated VAT regime due to diverse exemptions

Reduced rates among member states distorts competitiveness

|

With the GST Council approving on Saturday a draft law that seeks to compensate states fully in case of revenue loss as a result of GST, the tax reform is widely expected to come into usage by July 1.

The report also revealed that almost 57 per cent of all surveyed CFOs felt that GST will have the biggest potential impact on operations with wide repercussions for cash flow, tax accounting, supply chains, procurement as well as the technology framework.

On this note, the report called for adequate preparation and advance knowledge of the tax laws and rules is crucial for the success of GST.

"As an industry, we also need to do our planning correctly basis the legislation. Going forward, we may not need to have warehouses for commercial considerations and will keep them only when needed." Rajiv Batra, CFO, Cummins group of companies said.

In the case of more financially integrated Malaysia, which had introduced a new GST in April, 2015, the report pointed out that more than one and half years were given to private businesses to prepare. However, the move was not seamless with significant business disruption.

"The need for preparation may be even greater in India than Malaysia since the proposed tax is much complex than the Malaysian tax, with a dual GST regime and levy of GST on inter-state supplies of goods and services, including intra company stock transfers." the report said.

On the other hand, a plethora of exemptions for various sectors as well as diverging rates for member states have served to overly complicate the similar VAT regime in the European Union, it added.

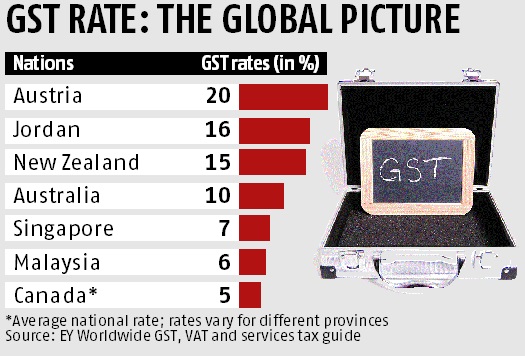

Back in India, the GST council is expected to perform the strenuous task of fixing tax rates for different goods and services by fitting them into the four approved slabs of 5, 12, 18 and 28 per cent.

It will also have to approve three other laws, the central, state and integrated GST respectively when it meets on March 4-5, paving the way for the legislations to be brought to Parliament by around March 9.

The situation is similar to Canada where the federal structure has mandated that different provinces have a wide range of differing rates. As a result, businesses have an equally wide range of tax problems on account of interpretation issues, the report said. With all provinces deciding to retain an older and separate retail tax structure, there is two levels of levies which are charged on the same.