Are You Prepared for Anti-Profiteering Provisions of GST

Every coming day, India is heading towards the date of introducing Goods and Services Tax (GST), which is slated to be implemented from July 1, 2017. GST in India has become one of the most awaited laws which is to implemented in next few days. But the Challenge of GST is -The process and complete tax regimes are still not clear to the taxpayers. Among all the upcoming provisions Anti-Profiteering Provision seems to be at the forefront of things.

What is the Anti-Profiteering Provision?

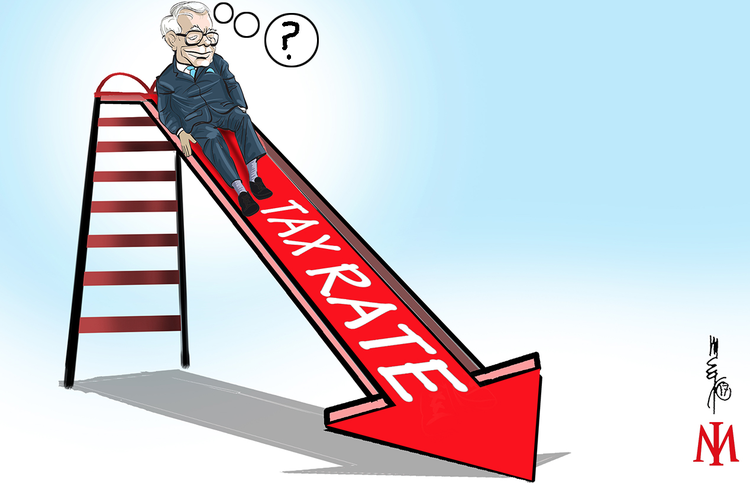

Our GST bill contains an anti-profiteering clause that mandates the manufacturer and others in the supply chain to pass on the benefits arising during the transition phase from current tax regime to GST regime, to the consumers.

Globally, Australia is said to be the first country to introduce an anti-profiteering provision during GST introduction in the year 2000, followed by Malaysia in the year 2015. Though there are no empirical studies have been conducted to prove its benefits, but Indian Government appears to be inclined to experiment with these provisions in India as well.

In Detail: The provision in the Central GST Act - Section 171, mandates that benefits arising due to either lower tax rates or more tax credits being available in the GST regime should be passed on to the consumer by way of commensurate reduction in prices. This section also empowers the Government to constitute an authority or entrust an existing authority to ensure compliance of anti-profiteering provisions. Therefore, it is of paramount importance for companies to set up processes to compute the likely benefits and have a plan to ensure smooth passage of the benefits to the consumer.

This provision can be understood in following steps-

1. Benefit Analysis Due to Lower Tax Rates and Increased Credits

Currently, guidelines to compute the benefits have not been prescribed, yet taxpayers can compute the likely benefit at a broader level. The provision categorizes the likely benefits in two baskets:

a) More Input Tax Credits Are to Be Available

At present, Central Sales Tax (CST) is a cost in the supply chain, while in GST regime there will be no CST. Today service providers cannot claim credit of VAT paid on goods, and traders cannot claim credit of excise/ countervailing duty and service tax. With new GST bill’s implementation these credits are expected to accrue to a taxpayer. Taxpayer should identify these benefits arising on account of transition to GST at organizational level and accordingly the company is supposed to pass the same benefits to it’s customers.

Tax benefits can also be computed at the product level based on a cost sheet.

b) Tax Rates Are to Be Reduced-

When the company calculated the benefits arising from credit, the next step is to compute benefits from rate reduction, if any. This benefit can be computed at the product level also.

Example- If each unit of a Pen of Rs. 50 attracts excise and Vat of 7 these day and after GST implementation If payable tax gets reduced to Rs. 4 the Rs. 3 will likely to be benefit on each unit.

2. Looping in Vendors / Supply Chain

At production level when company will get a clarity on the tax benefits then at the same time they will also have to ensure that their vendors pass on the benefits of this reduced tax by reducing the price of manufactured goods. In the process of doing this, the company will be required to get cost data from vendors. Once details are shared by vendors, their veracity should be verified by the company or through an independent firm, depending upon the capacity of the company. In case vendors are not willing to share details, some sample cost sheets can be prepared based on industry knowledge. The expected amount of benefits thus arrived at could be shared with vendors for confirmation and used for negotiation.

To ensure that vendors comply with the company’s requests, From July onwards it wil be advisable to add an appropriate anti-profiteering clause in vendor agreement stating that that the vendor agrees to comply with anti-profiteering provisions and to share authentic and verified data to ensure that the benefit is appropriately passed on in accordance with the provisions. Going a step further, the clause can also state that in case appropriate benefit is not passed to the customer, then the vendor will be held accountable to pay any future disputed liability along with interest, fine, penalty, litigation cost etc. This will save the company to face any kind of legal issue incase of any negligence of rules at vendor’s end.

3. Preparing for the Unknown

The anti-profiteering provisions in the GST bill are very brief, leaving enough room for misperceptions and perplexities. While the two steps mentioned above can help the company prepare for business conducted in the future, there are several questions on the business at hand that still remain unanswered. Questions such as-

How to change MRPs if products are already at the retail store?

- Is compliance mandatory even if the product is covered under drug pricing control order.

- What about the period in which company does not have time to renew vendor contract in case vendor denies to share the required details referring to the ongoing contract.

- For questions such as these, taxpayers need to be vigilant to announcements from the government on the topic and plan their processes accordingly.

We can just hope that the ant-profiteering provisions are not perceived as anti-industry and Government issues detailed guidelines to ensure that industry specific challenges are appropriately addressed.

In case you still have queries regarding GST, You can contact us to attend our GST Seminars, Webinars and Hand On Training Sessions. With Web-GST, We are focusing on addressing all the Challenges of GST that companies may face with filing their tax.