Have you finalized your GST Compliance Vendor?

Are You Ready for GST? Asking this question at this stage when GST has already been implemented w.e.f 1st of July, 2017 ALL over the country, would seem frivolous. All of us have already got on to the GST band wagon. Some might have got seated properly, others may be standing in the coach and some may even be standing precariously close to the doors. It is the time we assess where we stand vis-à-vis GST as it will determine how well we will fare in compliance of this technology driven law. Needless to state that business should function smoothly as it is of utmost importance for the business enterprise.

Accounting/ERP Software Ready for Accounting in GST regime

- Facility of Bulk Upload of GSTIN of Parties & Vendors

- Facility of Mass Updation of GSN/SAC code, GST Rates etc

- Facility of checking correctness of GSTIN

- Facility of Verification of Ledgers for GST Compliance

- GST Compliant Sales Invoice is generated to enable purchases to claim ITC

- Reverse Charge Mechanism (RCM) handled

- RCM Invoices generated to enable us to claim ITC

- Taxation of Advances Received from Parties & adjustment with Sale Invoices

- Taxation of Advances Paid to Unregistered Suppliers & adjustment with Purchase Invoices

- Data Security is not compromised

- Have accountants been trained to make correct masters and entries in accounts

- No deletion/addition of sales invoices and vouchers

- No back dated sales invoices and vouchers

Accounting/ERP Software GST Returns Ready

- Prepares Correct Returns in json format (Excel format is not acceptable)

- Seamlessly uploads returns through GSP

- Downloads data from GSTIN site

- Reconciles GSTIN data with own data

- Shows Errors and Effortless Correction Mechanism

- Mailing mismatches to other party for corrections

GST Compliance Due Dates

| GST Returns |

July |

August |

| 3B |

20th August |

20th September |

| GSTR 1 |

1st to 5th September |

16th to 20th September |

| GSTR 2 |

6th to 10th September |

21st to 25th September |

If most of the above crucial issues have been handled by your Accounting/ERP software or your team, then there is no cause for concern. But if you have not thought of above issues or the same have still not been tackled, you better gear up as time is of essence in compliance of GST law.

As you know that Time is of essence in compliance of GST law; Late Compliance/Non Compliance could adversely affect your Compliance Rating at GSTN, besides financial loss due to Interest, Penalties, Loss of Input Tax Credit etc.

We at Webtel, Best GST Software Provider in India, are providing GST Solutions to Corporates, Professionals and others. We have a team of professionals to help you in this journey of GST.

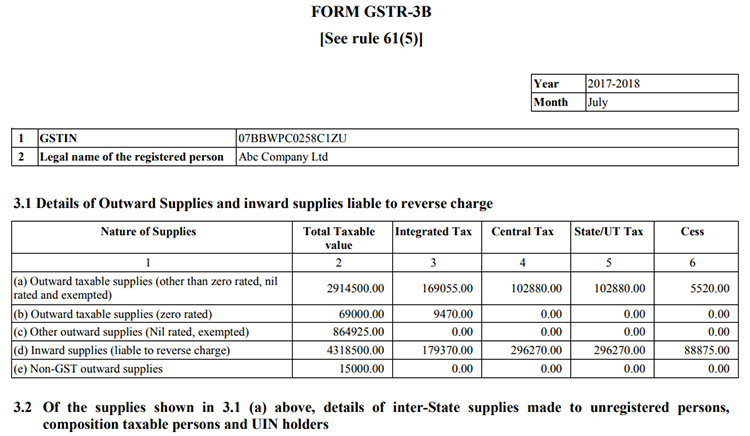

We all are ready with complete ASP-GSP Solution. Sharing Sample Form 3B generated from our software -WEB GST for your reference.

Please give us your valuable time to discuss the same to avoid any nasty surprises and complications in GST Compliances at a later date.

Contact Us:

Mr. Jayant Chauhan (9312931101)

Marketing Head

Team Webtel