Guide to E-Way Bill Generation and Documentation Online

Prior to the introduction of the GST, an e-Way bill was a physical document that contained details of shipment and the information of the supplier and recipient. It was a mandatory document for all shipments that had a value of Rs. 50,000 or more. This made it necessary to make several visits to tax offices and endure prolonged paperwork to receive an e-Way bill. This resulted in the delay of shipment as the vehicles carrying the goods often did not carry the e-Way bill required in time to pass through check gates.

The introduction of the e-Way Bill facility by the Ministry of Transportation on 1 April 2018 under the Goods and Services Tax regime has reduced the need to rely on tax offices to issue e-Way bills. The GST regime has entirely replaced the physical e-Way bill with the electronic one making the old process obsolete. The online facility has made it possible to generate e-Way Bills directly without a third party when required. The e-Way Bill facility can also be operated through Short Message Service (SMS) from a mobile phone. This requires prior online registration of the mobile phone number.

Image Source

Getting Started

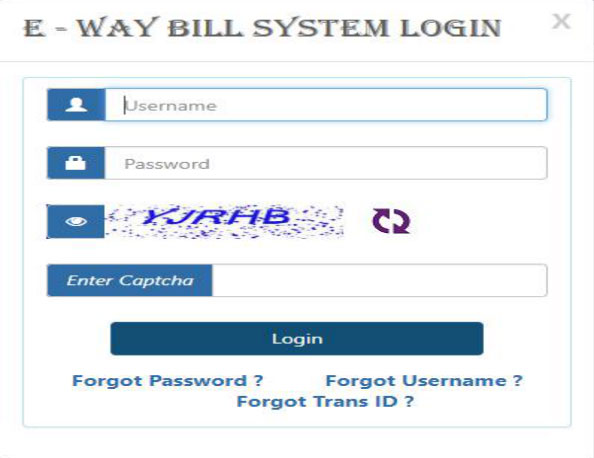

To utilise the e-Way Bill facility the first thing you should do is to register yourself on the e-Way Bill portal. Users will be required to enter their GSTIN number and a security captcha code in order to register online. Once the GST number has been entered the system will ask for other details. These details include the primary phone number, commercial address, trade name and more. In order to confirm the identity, an OTP will be sent to the user's registered mobile number to verify the authenticity of the user. Users can then enter their preferred username and password to enter the e-Way Bill system.

For existing users, the procedure remains the same. They simply have to use the existing user login ID and password to enter the system and generate a new e-Way bill.

Generating a New E-Way Bill

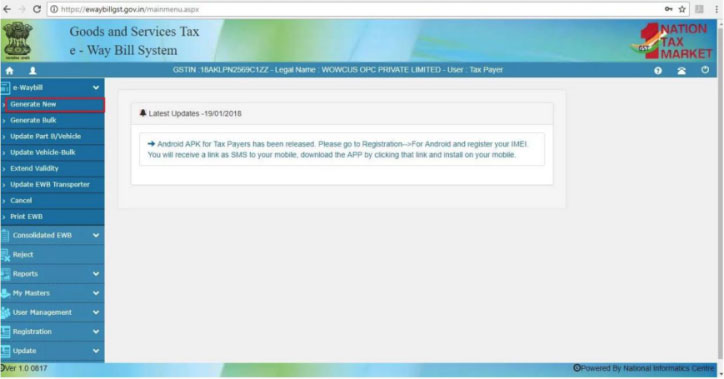

Once you've entered the e-Way Bill system, the steps to generate a new e-Way Bill are fairly straightforward. Simply select “Generate New” in the drop-down menu. Enter the “Transaction Type” and fill in the details depending on whether you are a supplier or a recipient. Next, the system will ask for a type of document. Users will be required to provide any of the following documents such as invoice, bill, challan, credit note and bill of entry. Let’s look at each document type in greater detail to understand the process better.

Documentation Type

Users must provide any of the following documents along with the serial number and the date on which the document was created.

| Documentation Type |

Description |

| Invoice |

A transactional document which is issued by a seller to a buyer which details items sold and with names of products, quantities, and agreed prices for products or services. |

| Bill of Sale |

A document that transfers ownership of goods from one person to another. |

| Challan |

An official form or a different kind of document which is a receipt for payment or delivery. |

| Credit Note |

A commercial document issued by a seller to a buyer as evidence of the reduction in sales. |

| Bill of Entry |

A document stating the exact nature, precise quantity and value of commodities that have landed or are being shipped out by an importer or exporter. |

Other Details Required

You will have to enter basic details in the form like the name of the recipient and sender along with their addresses and their respective GSTIN. Once done, the user will have to enter item details for delivery. By entering the item names, quantity and other details about the shipment, the system automatically generates the CGST, SGST, IGST, and CESS amounts.

Next, the system will ask users to enter the Transporter Name and Transporter ID.

| Transport Mode |

Transport ID Type |

| Transport by Road |

Transporter ID or Vehicle Number |

| Transport by Rail |

Transporter ID, Transport document number, and date on the document. |

| Transport by Ship |

Transporter ID, Transport document number, and date on the document. |

| Transport by Air |

Transporter ID, Transport document number, and date on the document. |

In order to enter all the required details effortlessly, make sure to keep all the necessary documents handy while generating your e-Way Bill. Losing the original copy of any one of these documents will cause you a great deal of inconvenience during shipment. Also, remember to check if you have entered any data incorrectly. Once you are done click on “Submit” to generate your e-Way Bill.