How to Generate an E-Way Bill through Web Portal?

E-Way Bill is the mandatory procedure for any consignment of goods which is above 50,000 rupees where the movement of goods is happening between intrastate or interstate. Thus to generate the bill, it is done by the either registered consignor or consignee. But in case of the unregistered parties it is the responsibility of the transporter to generate the bill. And in case of the non-generation of the bill the transporter is liable to pay the fine. It is the check system which is formulated to have an eye on the movement of goods.

The generation of the bill is the simplified process which can done by following few steps?

Hence, to begin with there are some documents which you must keep handy in order to begin with the generation of the bill and they are bill/ invoice/ Challan of the related consignment of goods, transporter ID or the vehicle number.The mode of transportation can vary from road, ship or rail thus the transporter ID must be generated likewise.

For the ease of large organizations/ transporter, E-Way Bill APIs has licensed GST Suvidha for generating e- way bills in real time. Therefore, you need to login to the E-way website in order to begin the process.

The e-way website: ewaybill.nic.in facilitates the process of bill generation. Thus firstly to commence with, one needs to login to the Govt. e-way bill portal. And then the required details like username, password is entered with the captcha code and you ought to click on the login bar.

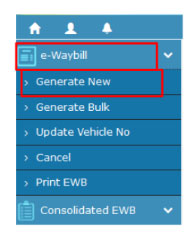

Then a page opens up which has the ‘e-waybill’ option on the left-hand side of the dashboard, wherein the drop-down list appears where you have to click on the ‘Generate new’ to receive the format of the E-way bill form i.e. EWB 01.

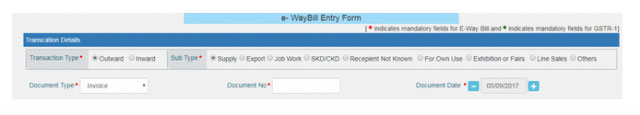

Just after the e-waybill form appears on the screen, if you are the supplier of the consignment, select ‘outward’ or the recipient of the consignment, select ‘Inward.

There are some details which must compulsorily get filled in order to complete the form. And they are

Document Type: You have to state that your bill is in which form and it can be invoice/ bill/ Challan/ credit note/ bill of entry and if these are not your document type select ‘others’

Document Number & Date: The number of the invoice has to be entered in order to identify the document and the invoice date has to be mentioned likewise.

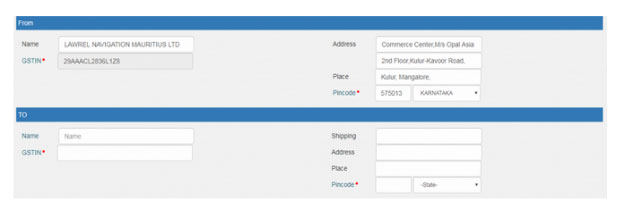

From/To: Here if the consignor is filling the details he/she is from and the consignee is to. Thus, one needs to fill the details as per the parties they belong to.

Item Details: Then there are some other crucial information which needs to be add i.e. the HSN code the details about the Product name, Description, HSN, Quantity, Unit, Value/ Taxable value, Tax rates of CGST/ SGST/ IGST in %, Tax rate of Cess in % (if any) has to furnished.

Transporter Details: The mode of transportation of goods,i.e. road/ rail/ air/ ship and the approximate distance covered in km must be mentioned. The transporter’s name, ID, transporter document no.& date or vehicle number must be mentioned likewise.

And once the details are entered one need to click on the ‘Submit’ button.If the details are not mentioned correctly, the system will automatically generate error. And after the successful generation of the E-Way Bill the form EWB 01 generates a unique 12 digit number which is the identity of the bill.

One gets the alternate to generate the consolidated E-Way Bills

If the movement of goods is in bulk and you want to consolidate them, you have the option to do so. One needs to click on the ‘Consolidated EWB’ which is on the left side of the dashboard under the drop- down menu of ‘Generate new’.

Thus, through EWB bulk converter or the excel file you need to convert the multiple e-way bills excel files into a single JSON file.

After this you need to upload the JSON file. And then click on the “Generate bulk”. And the bulk e- way bill can be generated by these simple steps.

The Transporter

It is the duty of the transporter to generate the E-way bill when both the consignor and consignee are unable to do so.

Thus,if the transporter is generating the E-way bill details of the both consignor and consignee has to be submitted in the form EWB-01 and a unique 12 digit number is generated afterwards.

The E-way bill under its portal allows the access to various other facilities as well and they are:

To generate the e-way bill, consolidate the e-way bill, reject it, to prepare reports, to create the masters of customers, suppliers, products and transporters, user can also create, modify and freeze the sub-users and one register for SMS, android app and API facilities, etc.

In Case of Updating the Vehicle Number

Keep your E-way bill and the new vehicle number handy for the speedy process. But for updating the vehicle number you are asked to mention the reasons for the same. Where the system gives the leverage to select the justified reason and just after this you need to enter the details in the required field for the new vehicle.And the rule is applicable to all the modes of transportation be it ship, air or rail.

If you Require to Cancel your E-Way Bill

The cancellation of the bill can be only done by the supplier. They can be cancelled within 24 hours of generation of the E-way bill. Thus, you need to click on the cancel option and then enter the unique 12 digit number of the bill. The reason for cancelling the bill has to be stated and then the cancellation process takes place.

Note: If the inspection of the bill has happened, it cannot be cancelled. Moreover, if the validity of the bill gets expired, it automatically gets cancelled and the fresh E-way bill has to be generated.

Is filling E-Way Bill is a concern for you? And you have not generated the e-way bill by your own before? Then avail the Web-GST service from the Webtel that simplifies each process to you. The various lucrative features of this service are surely going to lessen your burden. Hence, be rest assured as we offer you integrated accounting Software, invoice mismatch report in different Categories, status of uploaded Invoices etc.