How to Generate E-Way Bills via SMS?

Image Source

E-Way Bill is the kind of invoice which needs to be generated when the interstate or intra- state movement of goods takes place and it is mandatory to do if the value exceeds 50,000 rupees. Although there are exceptions to the rule, thus in case of the inward or outward supply of the goods either of the registered consignor and consignee has to furnish the E-way bills. And if they are unable to, it is the responsibility of the transporter to do so.

The E-way can be generated by filling the form EWB01 which is divided between two parts and the part A has the details of GSTIN of recipient, place of delivery, PIN code, invoice or Challan number and date, value of goods, HSN code, transport document number (Goods Receipt Number with the Railway Receipt Number or Airway Bill Number or Bill of Lading Number) and reasons for transportation has to be entered and whereas part B consists of transporter details and i.e. Vehicle number.

Thus, for the ease of the people and to reduce the lengthy process the government has provided two alternates to generate the E- way and they are through website portal and by SMS.

E- Way Bill can be generated through SMS and they bring about huge benefit for those who are not equipped with the computer. It is also a mechanism which is helpful in emergencies such as in night or when one is travelling. And the only basic criteria for filling the e-way bill through SMS is that one must have the registered mobile number.

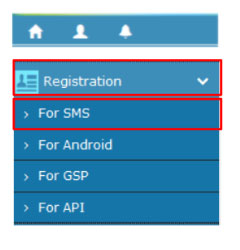

The SMS is generated in 7738299899 for the generation of the E-way bill/ to cancel it/to update the vehicle number by following the simple steps. For registering the number one needs go through the e-way portal where under the registration tab one needs to click on the option “for SMS” to register their mobile number.

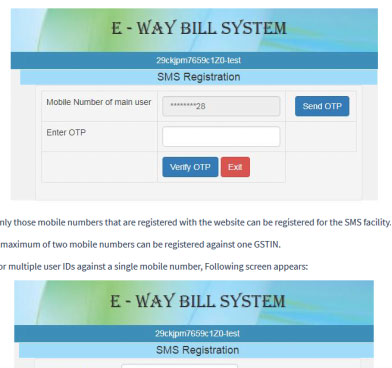

And after that the screen is displayed wherein the mobile number has to be entered which is to be registered. Thereafter, one needs to click on the "Send OTP". And after the generation of OTP it is entered on the required column and then clicked exit.

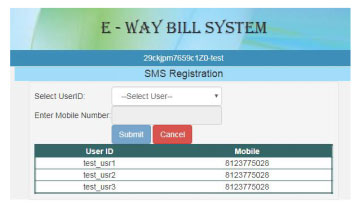

After following these steps user ids is displayed on the screen and proceeding ahead the screen appears where the registered mobile number and the user ID has to be populated.

And after that you need to click on the submit button and the system allows you to generate the e- way bill through SMS mode.

Note: It is not only the generation of the E-way bill, which happens with the SMS but the cancelling of the e-way bill and updating of the vehicle number too can be done by following some easy steps.

The Generation of the E-Way Bill by the Supplier

For the supplier of the E-Way Bill the SMS format is

EWBG TranTypeRecGSTINDelPinCodeInvNoInvDateTotalValueHSNCodeApprDist Vehicle

And the abbreviation for the following goes on like this:

| EWBG |

e-Way Bill Generate Key Word denotes the act. |

| TranType |

Transaction Type must be referred to the Code list. |

| RecGSTIN |

Recipient’s GSTIN (GST Identification Number). |

| DelPinCode |

PIN Code of Place of Delivery. |

| InvNo |

GST Invoice or Bill Number of the document of supplier. |

| TotalValue |

Total Value of goods as per Invoice/Bill document in Rupees. |

| HSNCode |

HSN Code of the first Commodity. |

| ApprDist |

Distance in kms from the consignor to the consignee. |

And the further Tran type which can be helpful for you:

| Outward Supply Type |

| OSUP |

Outward Supply |

| OEXP |

Outward Export |

| OJOB |

Outward Job Work |

| OSCD |

Outward SKD/CKD |

| ORNK |

Outward Recipient Not Known |

| OFOU |

Outward For Own Use |

| OEOF |

Outward Exhibitions & Fairs |

| OLNS |

Outward Line Sales |

| OOTH |

Outward Others |

| ISUP |

Inward Supply |

| IIMP |

Inward Import |

| ISCD |

Inward SKD/CKD |

| IJWR |

Inward Job Work Returns |

| ISLR |

Inward Sales Returns |

| IEOF |

Inward Exhibitions & Fairs |

| IOTH |

Inward Others |

The Generation of the E-Way Bill by the Transporter

And when the bill is generated by the transporter, the format for the SMS goes on like this:

EWBT TranTypeSuppGSTINRecGSTINDelPinCodeInvNoInvDateTotalValueHSNCodeApprDist Vehiclethe basic requirement is a registered mobile number for your business.

And the meaning for the abbreviation goes on like this:

| EWBG |

e-Way Bill Generate Key Word – It is fixed for generation |

| TranType |

Transaction Type -Refer to the Code list |

| RecGSTIN |

Recipient’s GSTIN or URP for ‘Unregistered Person’ |

| SuppGSTIN |

Supplier’s GSTIN or URP for Unregistered Person |

| DelPinCode |

PIN Code of Place of Delivery of Goods |

| InvNo |

Invoice or Bill Number of the document of supplier of goods |

| InvDate |

Invoice or Bill Date of the document of supplier of goods |

| TotalValue |

Total Value of goods as per Invoice/Bill document in Rs. |

| HSNCode |

HSN Code of the first Commodity |

| ApprDist |

Approximate distance in KMs between consignor and consignee |

| Vehicle |

Vehicle Number in which the goods is being moved |

To Cancel a Particular E-Way Bill through SMS

You need to enter the following text in your SMS EWBC EWB_NO

For example EWBC 1205690123581 whose abbreviation is as follows:

| EWBC |

E-Way Bill Cancellation Key Word, which remains constant |

| EWBNo |

12 digits E-Way Bill Number, which has to be cancelled and it varies from bill to bill. |

The E- way bill can be terminated within 24 hrs. of its generation, but once it is verified it cannot be cancelled.

Update Your Vehicle Number through SMS

And in case of updating the vehicle number, the format of the SMS has to be

EWBV EWB_NO Vehicle ReasCode

For example: EWBC 1205690123581ABC1115BRK. And the abbreviation means

| EWBV |

e-Way Bill Vehicle Updating Key Word, which remains constant |

| EWBNo |

12 digits E-Way Bill number for which the new vehicle has to be added |

| Vehicle |

Vehicle number for the movement of goods |

| ReasCode |

Reason Code to indicate why the vehicle number is being added. |

And the Reas Code has further following option

| FST |

First Vehicle |

| BRK |

Break Down |

| TRS |

Trans Shipment |

| OTH |

Others |

Feasibility: Now generating bill through SMS is also possible, which helps you in saving time and generating the bill without internet connection. Thus, through Webtel go through our Web-GST service which explains about each and every matter which comes under the purview of GST where E-Way is one such mechanism. And thus by the click generate the bill as per your convenience.